Recently, security in online banking has become one of the most discussed topics. Every day, more and more people are turning to digital financial services, and banks are actively introducing new technologies to ensure the security of their customers. In this context, Tinkoff, one of the leading banks in Russia, offers its clients the use of biometric data to protect their transactions.

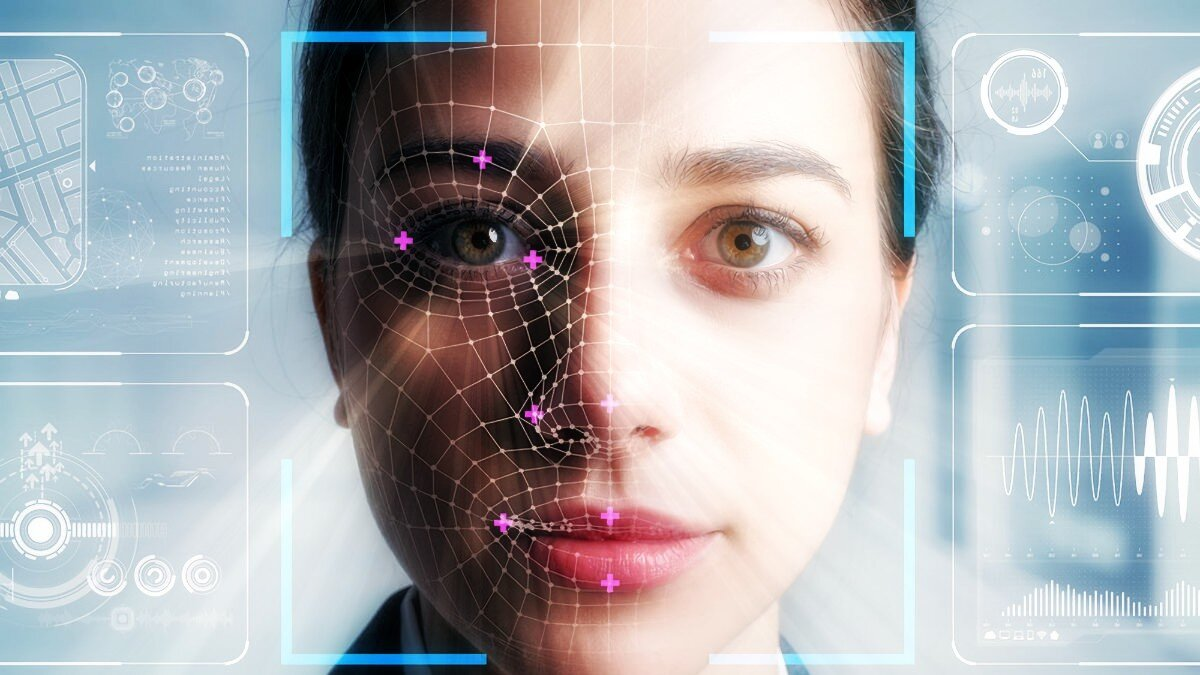

According to information published in Kommersant, since the end of September, Tinkoff began asking its clients for consent to process their photographs to convert them into biometric data format. This data is then transferred to the Unified Biometric System (UBS), which is used to improve the security of transactions, issuance of loans and authentication during remote servicing.

Advertisement

However, as the publication notes, some of the bank’s clients expressed concern about the processing and storage of their biometric data. The “story” where the information was posted received more than three and a half thousand comments. Bank representatives notified clients that their data would be placed in the EBS.

Most of all, customers were outraged by the way information was presented – in stories, and not through SMS or push notifications. In addition, the bank did not provide a choice, placing only one “allow” button. The bank said that users can revoke consent to data processing through Russian Post or by personally contacting the bank, including remote servicing.

However, such a bank decision may have several advantages. Firstly, the use of biometric data makes it possible to enhance the security of client transactions. Traditional authentication methods such as passwords and PINs can be compromised or stolen. While biometric data, such as fingerprints or facial scans, are unique and difficult to fake.

Secondly, the use of biometric data makes the service process more convenient and faster. Instead of entering complex passwords or PIN codes, customers can simply use their physical characteristics to authenticate. This reduces the time spent logging into the application and simplifies the transaction process.

Advertisement

Overall, Tinkoff’s proposal to use biometric data to ensure secure transactions is an important step in the development of online banking. Biometrics provide an additional level of security and also simplify the service process. However, each customer must decide for themselves whether they wish to use this option and have the opportunity to withdraw their consent if necessary.

More on the topic: