The predictive models of a new scientific study have managed to date what would be the “end of bitcoin”, already mistakenly announced so many times. Dive into these bad luck statistics.

Predict the unpredictable. Humanity has always nourished this fascination with the power to push back the unknown. A legitimate ambition in the face of incessant health, political and humanitarian crises. Progress made accessible by the study of complex systems, from cells to societies, naturally including stock markets. The French geophysicist, Didier Sornette, has built an international reputation through his models for predicting financial instability.

Advertisement

In his reference work (the title of which could be freely translated as “ Why stock markets are crashing “), the scientist developed a theory capable of predicting economic collapse years in advance. Using physical and statistical modeling techniques, his analysis goes back to what he considers to be the root of the problem: the appearance of a speculative bubble.

It is a phenomenon of meteoric rise in prices on the markets, disconnected from reality, but fueled by speculators who come to base their behavior on the sole imitation of other investors. For example, if your brother-in-law Jean-Marc and your colleague Corine are currently banking on tons of cocoa, it would be disturbing to let them get rich on their own.

This mimicry creates an upward spiral, an unsustainable inflation of stock prices, until the inevitable bursting of the bubble. With losses and clashes as the main consequences. The bursting of the “.com bubble” twenty-two years ago plunged the United States into recession.

With his sophisticated measurements and projections at the start of speculative bubbles, Didier Sornette managed to anticipate the “end of the era of growth” which would occur around 2050.

Advertisement

Bitcoin, “the mother of all bubbles”

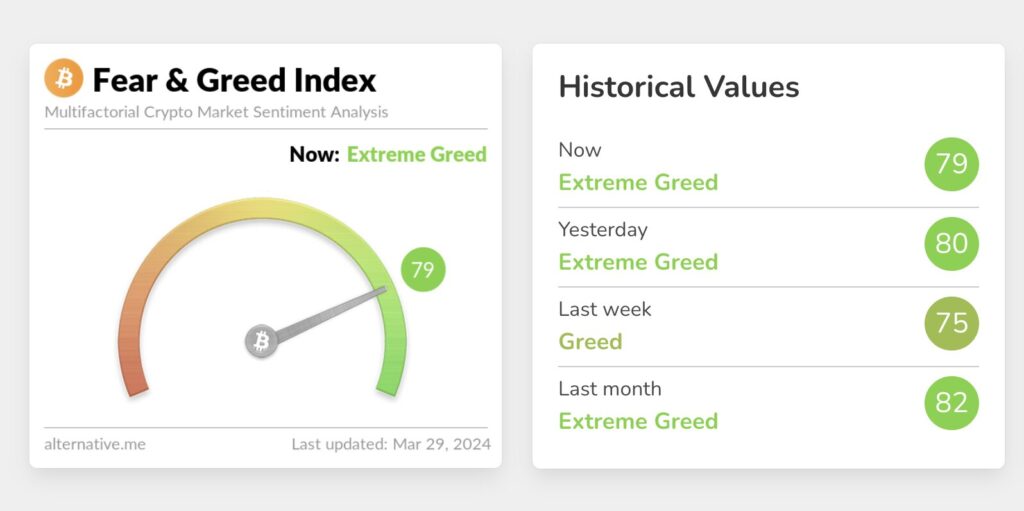

At the time of writing these lines, the most (un)popular of all cryptocurrencies is seeing its price move above the symbolic milestone of $70,000 (or 6,500 euros per unit). Bitcoin thus leads to a digital asset market which currently weighs more than 2,600 billion dollars.

Each time the price of BTC returns to the skies, dizzying concerns are spontaneously expressed in the spheres of information and political decisions. During the crypto boom of 2017, the European Commissioner for Financial Stability at the time was alarmed “ clear risks to investors and consumers associated with price volatility — including complete loss of initial investment, operational and security failure, market manipulation and accountability gaps “.

The European Commission then took on its own account without any other form of analysis of the fears already expressed by regulatory authorities and large banks.

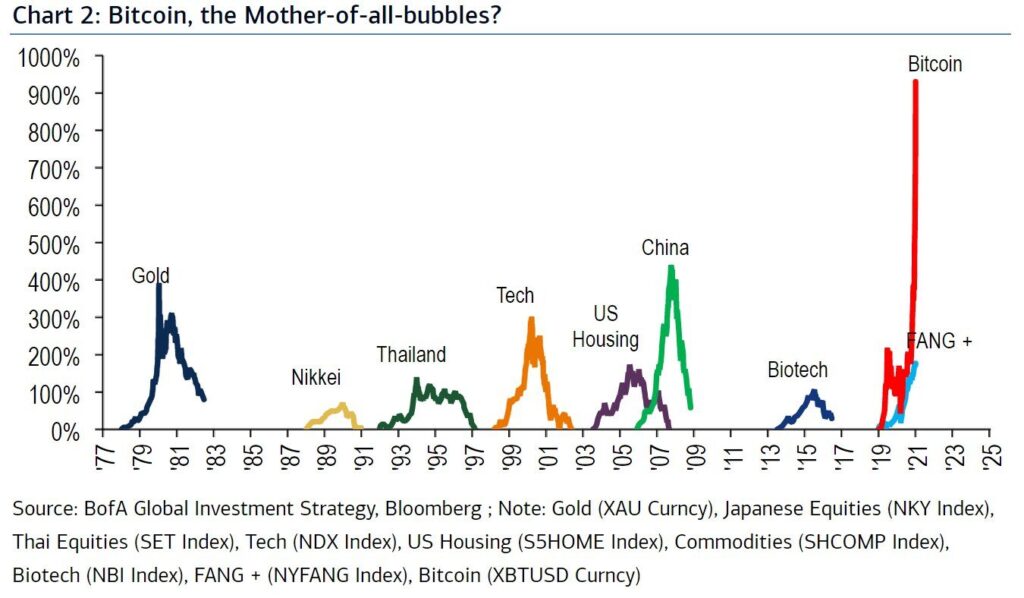

Accustomed to vindictiveness since its emergence, accused of almost all afflictions, the Bitcoin blockchain had notably been accused of “mother of all bubbles” in 2021 by the famous financial brand Bank Of America.

In the opinion of many detractors, the repeated earthquakes suffered by the crypto planet in 2022 supported the hypothesis of a speculative bubble which had just burst.

Making public blockchain data speak

Notably, the scientific literature has not yet resolved the debate around the Bitcoin Bubble. “ It is extremely unusual for a bubble to burst and then return to new highs so quickly », Underlined at the beginning of the month the president of Rockefeller International, Ruchir Sharma, in a platform of Financial Times. “ This suggests that something real and lasting is happening “. It remains to be seen what exactly is going on, between new digital gold, long-term investment and currency of the digital economy. And how long will BTC last?

This sets the stage in which Klaus Grobys engages in what could resemble clairvoyance or numerology to guess the future of bitcoin. But far from pseudo-sciences, this doctor in finance from the University of Vaasa, in Finland, was inspired by the work of Didier Sornette to build a mathematical prediction model.

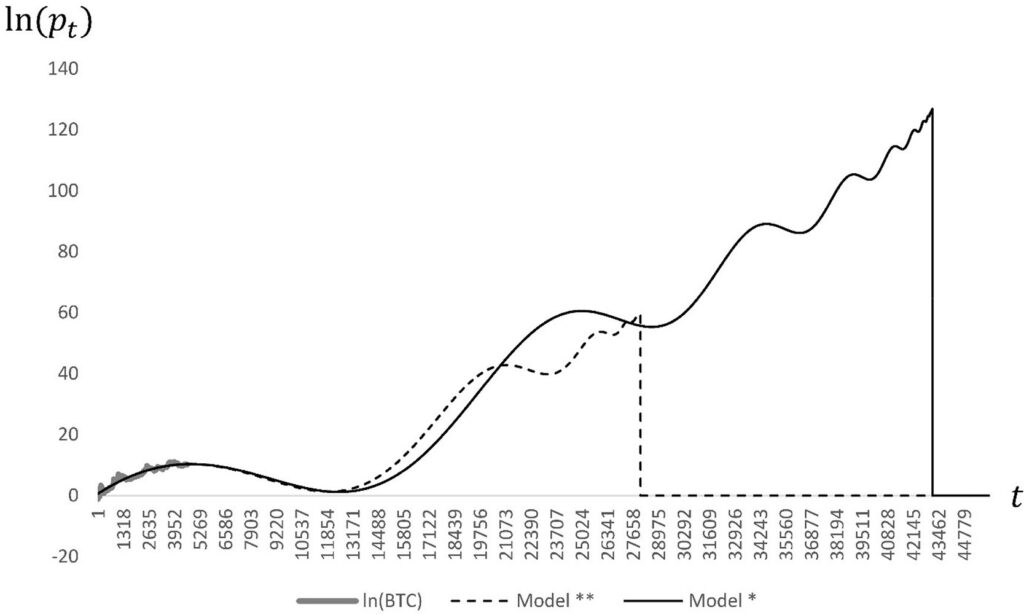

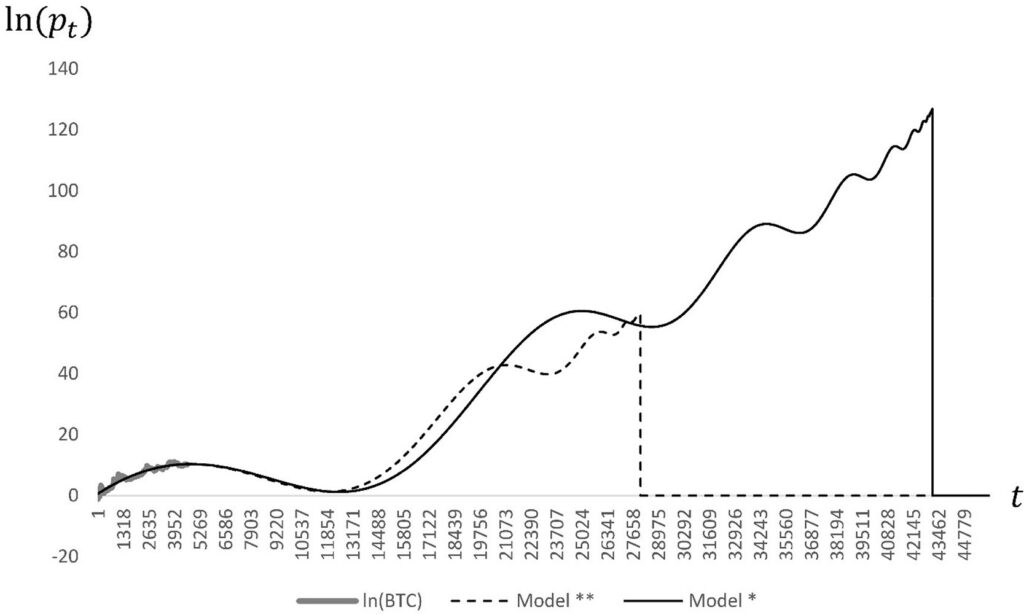

Eager to make the data from the Bitcoin network speak, the Finnish professor injected twelve years of descriptive statistics, i.e. a sample of 4,634 daily measurements (the relative changes in the value of the asset, called logarithmic returns for those familiar with the research university).

The precise time of a financial crash and its trigger remain unpredictable. But Klaus Grobys notably adapted diagnostic models for bitcoin bubbles and crashes to predict the explosiveness of cryptocurrency prices. In order to determine a mathematical relationship between likely variables and thus predict the date of a collapse.

Like an electroencephalogram whose trace would be flat, the results of Klaus Grobys' study to appear in the magazine Financial Research Letters suggest that BTC prices will reach near zero around February 2045.

The “brain death” of BTC now planned?

Given this upcoming zero value, “ investors who want to use bitcoin as a long-term investment may face deception », Estimates the author. This annihilation coincides with the time horizon of Didier Sornette's disaster scenario established for the American stock markets.

Importantly, Grobys' results devalue the idea that demand might be driven by expectations about bitcoin's future usefulness as a medium of exchange. On the contrary, ” We argue that this decline into the distant future corroborates the scientific literature which shows that the demand for bitcoins results from speculation », insists the doctor in finance from the University of Vaasa.

Based this time on so-called exact sciences, this announced end of bitcoin refreshes a long tradition of more or less well-founded death threats (there are almost 500 in English alone). But this remains a deductive approach. However supported the numerical hypothesis may be, the consequences deduced and observable in the near future do not constitute indisputable proof.

The results of the study also predict another area of turbulence around March… 2129. “ Taking into account the uncertainties, we cannot reject the hypothesis that the arrival of this disruption coincides with the time when the last bitcoin will be mined, i.e. by 2140 », concedes Klaus Grobys.

At that point, BTC rewards will give way to network participation fees. If revenues no longer cover costs, miners will no longer have an incentive to put in effort to maintain the blockchain. A situation in which some scholars expect that “ bitcoin goes bankrupt “. Definitely. Until proven otherwise, of course.