Inflation also concerns subscriptions to Internet boxes, which are experiencing a significant increase in their price. We observe different strategies from one ISP to another.

Inflation is everywhere and even affects Internet packages. While France is seeing its prices soar (+4.8%), ZoneADSL&Fibre has decided to analyze this phenomenon in the telecommunications sector. This specialist in comparing telecom operators has noted a general increase in the prices of Internet boxes, of around 3.5%.

Advertisement

Internet box: who increases their prices the most?

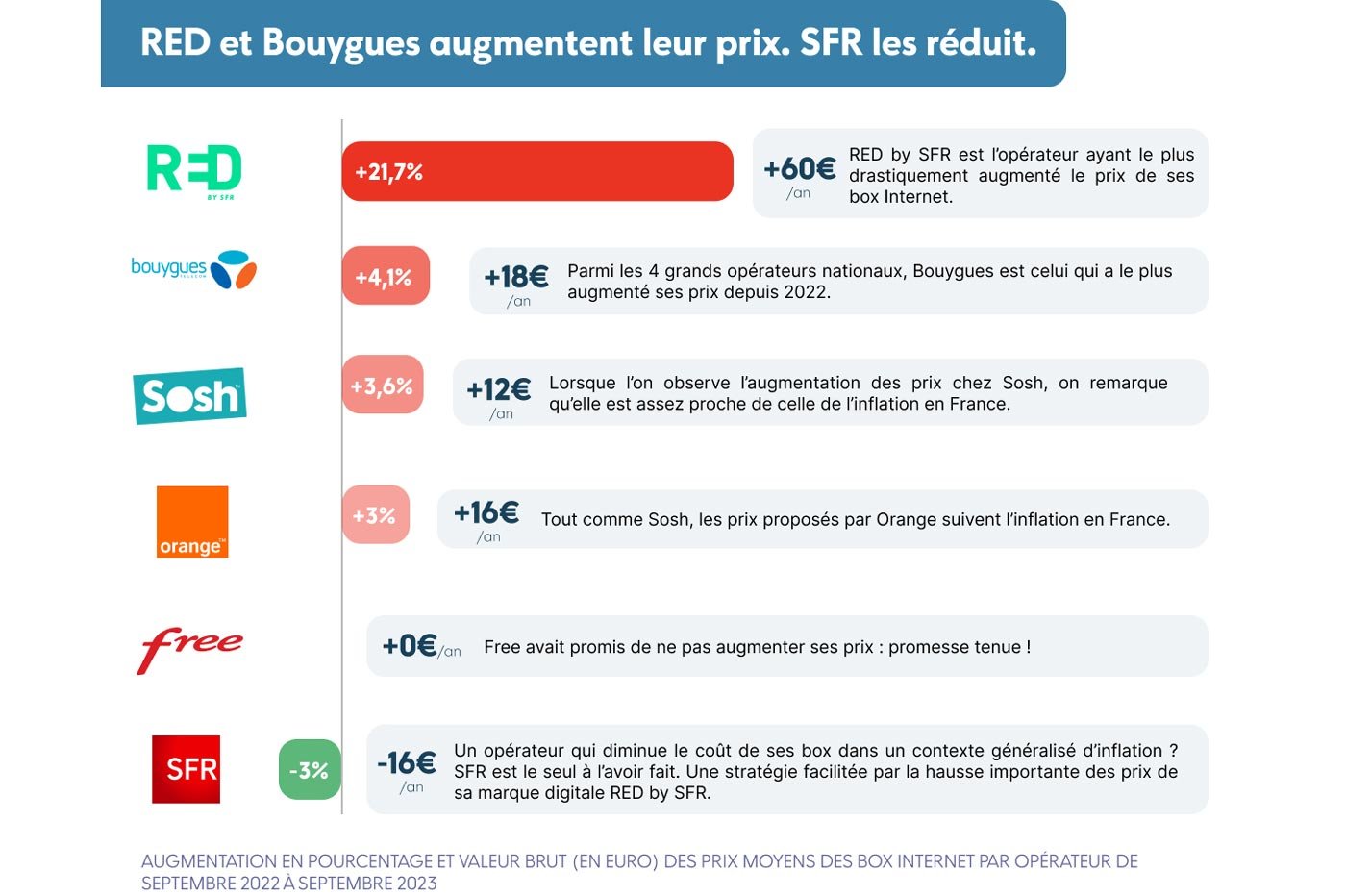

Faced with the context, Internet service providers are opting for very different strategies. The most spectacular increase concerns RED by SFR which increased its prices by 21.7% in one year (+60 euros/year) over the period between September 2022 and September 2023.

Behind, Bouygues Telecom stands out with an increase of 4.1% over one year (+18%) and is ahead of Sosh (+3.6%). Orange’s low-cost brand seems to follow inflation in France, like its parent company (+3%). As for mobile plans, Free stands out by not increasing its prices while SFR is the only operator to reduce the cost of its boxes (-3%). The red square operator preferred to increase the price of Internet boxes from its digital brand RED by SFR.

It is important to note that the analysis of ZoneADSL&Fiber is based on the prices of fiber offers from each fixed operator. It does not take into account exceptional promotions.

The end of low-cost boxes?

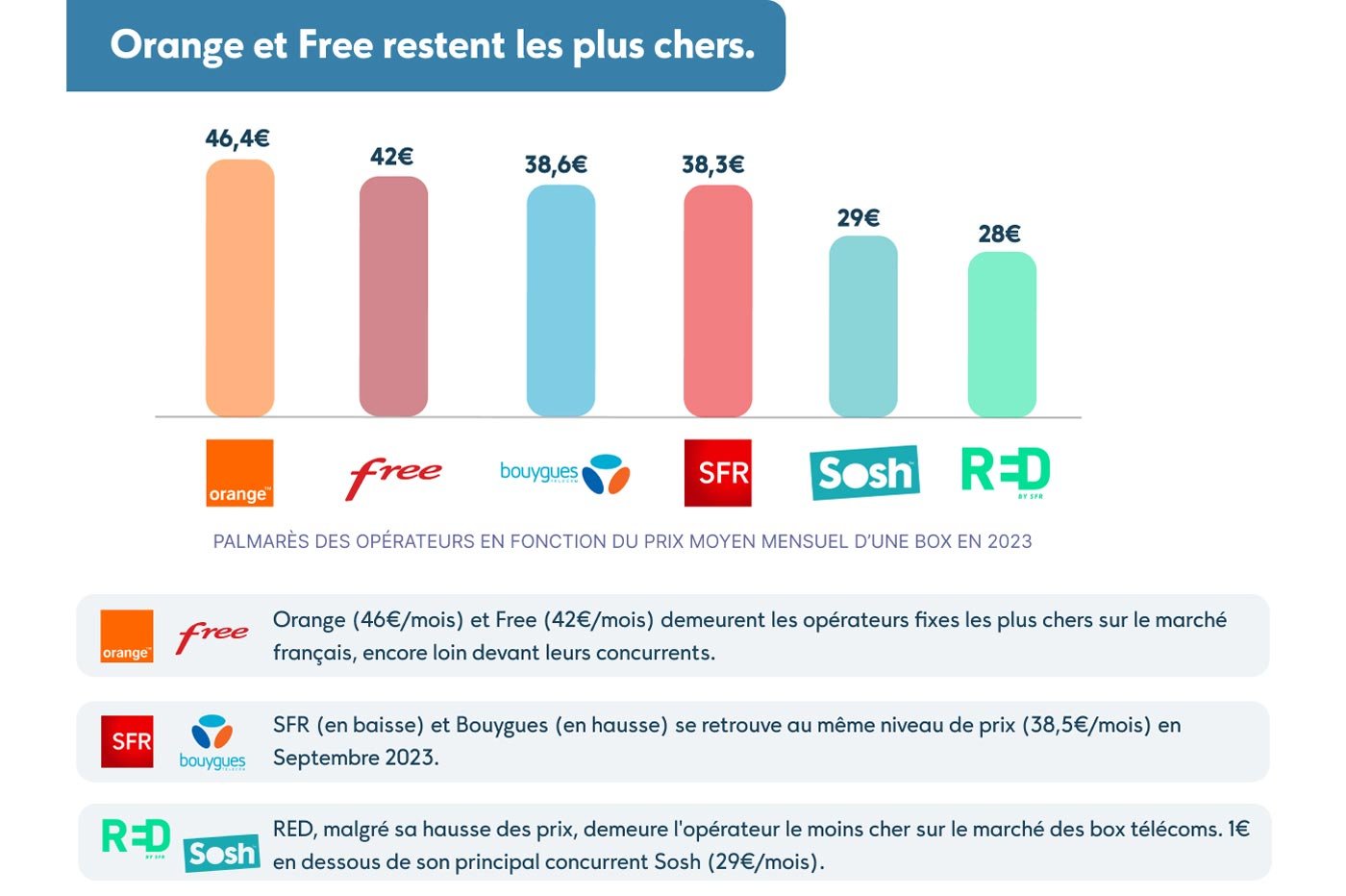

Regarding prices, Orange (46 euros/month) and Free (42 euros/month) remain the most expensive fixed operators on the French market. They are quite well ahead of their competitors Bouygues Telecom (up, to 38.6 euros/month) and SFR (down, to 38.3 euros). The two ISPs are very close, also displaying the same price level in September 2023 (38.5 euros/month). Finally, the low cost brands Sosh (29 euros/month) and RED by SFR (28 euros/month) logically display more affordable prices. Despite its price increase, RED therefore remains the cheapest operator in the sector.

Advertisement

These recent increases demonstrate a loss of speed for low-cost boxes. Long highlighted by operators, entry-level boxes are the most affected by the surge in prices (+5%). They are much more so than high-end boxes, which ultimately increased very little (+0.5%). As a result, less aggressive competition is observed between major market players.

However, we note a slight price increase at Orange on the occasion of the release of Livebox 7. Before the end of the year, it will also be interesting to follow the positioning of Free with its Freebox v9.

The telecoms regulator, Arcep, also notes an increase in the prices of fixed offers. In numbers published on October 5He is pointing out that “the average consumer bill for the use of high or very high speed Internet access […] amounts to 34.5 euros excluding tax per month » in the second trimester. Arcep has noted “continuous” progress since the start of 2020.

In 2023, the increase accelerates, reaching 90 cents (excluding taxes) in the first quarter of 2023 and 1.2 euros in the second. In one year, the average subscription bill increased by 3.7% according to Arcep’s findings.